Introduction

Choosing accounting software isn’t just about features — it’s about cost, scalability, and total value over time.

In 2026, small businesses can expect accounting software pricing to range anywhere from $0 to $200+ per month, depending on:

- Features

- Number of users

- Payroll integration

- Inventory tools

- Automation capabilities

This guide breaks down what small businesses actually pay for accounting software in 2026, compares major providers, and helps you choose the best option for your budget.

Quick Comparison: Accounting Software Pricing (2026)

| Software | Starting Price | Mid-Tier | Advanced Tier | Payroll Add-On | Best For |

|---|---|---|---|---|---|

| QuickBooks Online | ~$30/mo | ~$60–$90 | $200+ | Extra | Growing SMBs |

| Xero | ~$15/mo | ~$42–$78 | $100+ | Extra | Small teams |

| FreshBooks | ~$19/mo | ~$33–$60 | $100+ | Add-on | Freelancers |

| Wave | Free | N/A | N/A | Paid add-on | Startups |

| Zoho Books | ~$20/mo | ~$50–$70 | ~$150 | Add-on | Budget-conscious SMBs |

Pricing varies by promotions and region. Always verify current pricing.

How Accounting Software Pricing Works

Most platforms use a tiered subscription model:

1) Starter Plan ($0–$30/month)

Best for:

- Freelancers

- Very small businesses

- Simple bookkeeping

Includes:

- Income & expense tracking

- Basic reporting

- Limited users

- Limited invoices

Limitations:

- No inventory

- Limited automation

- Limited integrations

2) Mid-Tier Plan ($40–$90/month)

Best for:

- Small businesses with employees

- Growing companies

- Service-based businesses

Includes:

- Advanced reporting

- Bank feeds

- Multi-user access

- Some automation

- Basic inventory (sometimes)

This is where most small businesses land.

3) Advanced Plan ($100–$200+/month)

Best for:

- Scaling businesses

- Multi-entity companies

- E-commerce operations

- Inventory-heavy businesses

Includes:

- Advanced analytics

- Multi-currency

- Inventory management

- Workflow automation

- Custom reporting

What Small Businesses Really Pay in 2026

The advertised base price isn’t the full picture.

You must consider:

i) Payroll Add-Ons

Typically $30–$80/month + per employee fees.

ii) Additional Users

Some platforms charge per user.

iii) Inventory Features

Often locked behind higher tiers.

iv) Payment Processing Fees

Usually 2.9% + transaction fees.

v) App Integrations

Third-party tools may cost extra.

Example: Real Monthly Cost Scenarios

Solo Freelancer

Starter plan ($20–$30)

No payroll

Total: ~$25/month

Small Team (5 employees)

Mid-tier plan ($60)

Payroll add-on ($50+)

Total: ~$110–$140/month

Growing E-commerce Business

Advanced plan ($150+)

Inventory tools

Payroll

Total: $200–$300/month

Understanding total cost prevents surprises.

Cheapest Accounting Software Options (2026)

If budget is your primary concern:

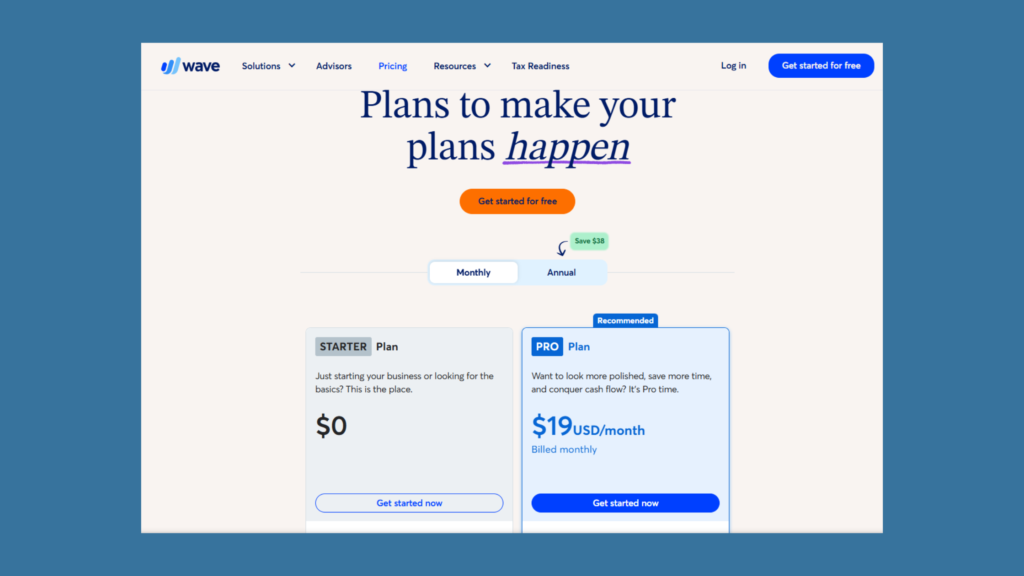

Wave (Free Plan) [Price below obtained on the 20th of February 2026]

- Free accounting core

- Payroll costs extra

- Limited scalability

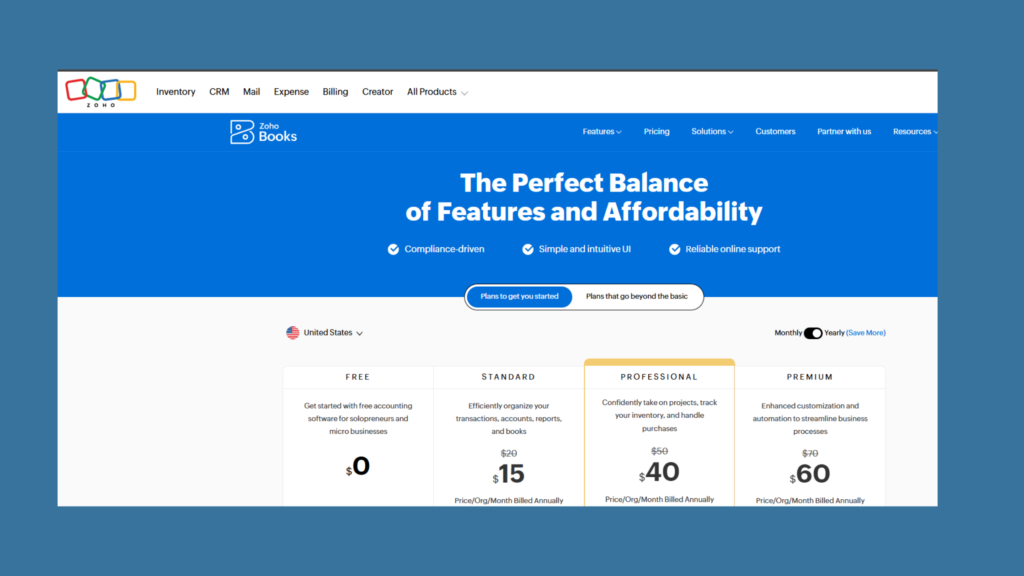

Zoho Books (Entry Tier) [Price below obtained on the 20th of February 2026]

- Strong value pricing

- Affordable upgrades

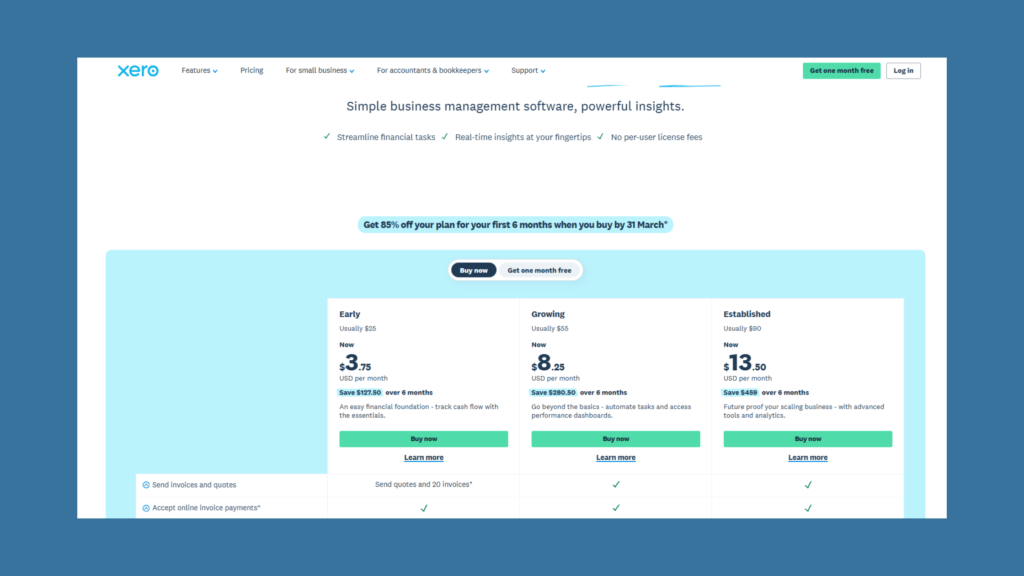

Xero (Early Tier) [Price below obtained on the 20th of February 2026]

- Competitive entry pricing

- Strong integrations

However, cheapest is not always best long-term. So you will need to upgrade to a plan that serves your business needs as the business grows.

When Paying More Makes Sense

Higher-tier software can justify cost through:

- Time savings

- Automation

- Reduced errors

- Better financial insights

- Scalable infrastructure

For businesses generating revenue consistently, spending an extra $40/month can save hours of manual work.

Accounting Software Cost by Business Type

| Business Type | Typical Monthly Cost |

|---|---|

| Freelancer | $0–$30 |

| Small Service Business | $40–$90 |

| Retail/E-commerce | $100–$250 |

| Growing SMB | $150–$300 |

Your software cost should scale with complexity — not revenue alone.

How to Choose the Right Pricing Tier

Ask:

- Do you need inventory?

- Do you need payroll?

- How many users require access?

- Do you need multi-currency?

- Are integrations critical?

Choose based on operational complexity, not just price.

Accounting Software vs DIY (Excel)

While Excel is “free,” the hidden costs include:

- Manual errors

- Time investment

- Lack of automation

- No audit trail

- Poor scalability

Most growing businesses outgrow spreadsheets quickly.

For a deeper comparison, see:

➡️Accounting Software vs Excel for Small Businesses

Best Value Accounting Software in 2026

If balancing price and functionality:

✔ Best Overall Value: QuickBooks Online (mid-tier)

✔ Best Budget Option: Zoho Books

✔ Best for Freelancers: FreshBooks

✔ Best Free Entry: Wave

✔ Best Scalable Option: Xero

Each suits different growth stages.

For full feature breakdowns, see:

➡️Best Accounting Software for Small Businesses (2026)

Final Verdict: What Should You Budget in 2026?

Most small businesses should realistically budget $50–$150 per month depending on complexity and payroll needs. Spending less may limit growth, whilst spending more without need wastes cash.

The key is alignment between:

- Business size

- Growth stage

- Feature requirements

- Budget discipline

Ready to start using accounting software for your accounting? Start Your Free Trial of Xero