Introduction

Paying your team on time — without headaches, compliance errors, or surprise fees — is an essential part of growing a small business.

But if you’re price-conscious or just starting out, full-featured enterprise payroll tools might feel too costly. The good news? There are affordable payroll services in 2026 that still deliver:

- automated tax filing

- direct deposit

- support for contractors

- compliance tools

- easy onboarding

In this guide, we look at the best affordable payroll services for small businesses in 2026 — comparing pricing, features, strengths, limitations, and real use cases.

Why Affordability Matters (But So Does Value)

Low cost shouldn’t mean low quality.

The right affordable payroll service should still provide:

- correct tax calculations

- timely payments

- compliance with federal & state requirements

- clear reporting

- support when you need it

Let’s evaluate the best cost-effective payroll solutions you can use right now.

Quick Comparison: Best Affordable Payroll Services (2026)

| Payroll Service | Starting Cost | Per Employee Fee | Tax Filing | Best For | Ease of Use |

|---|---|---|---|---|---|

| OnPay | ~$49/mo | ~$6/employee | Included | Small teams & contractors | ⭐⭐⭐⭐ |

| Patriot Payroll | ~$10/mo | ~$4/employee | Optional | Microbusiness & startup | ⭐⭐⭐ |

| Gusto (Simple) | ~$40/mo | ~$6/employee | Included | Full small business payroll | ⭐⭐⭐⭐ |

| Wave (via integrations) | Free | Depends on add-ons | Manual | Budget payroll entry point | ⭐⭐⭐ |

| Square Payroll | ~$35/mo | ~$5/employee | Included | Retail + small teams | ⭐⭐⭐⭐ |

(Pricing is approximate and varies by region, features, and add-ons. Always check current pricing before subscribing.)

1) OnPay — Best Overall Affordable Payroll Service

Best for: Small businesses that want full payroll features at a predictable price.

Pricing

- ~$40 base per month

- ~$6 per employee monthly

What You Get

✔ Full tax filing (federal & state)

✔ Contractor & employee payroll

✔ Multi-state payroll support

✔ Simple reporting

Why It’s Affordable

OnPay combines payroll, tax filing, and contractor support at a very accessible price — without forcing you into costly add-on tiers.

Pros

- Transparent pricing

- Full tax filing included

- Easy setup

- Clean user interface

Cons

- Not as many advanced HR features as enterprise platforms

Best choice if you want a strong core payroll service with predictable pricing.

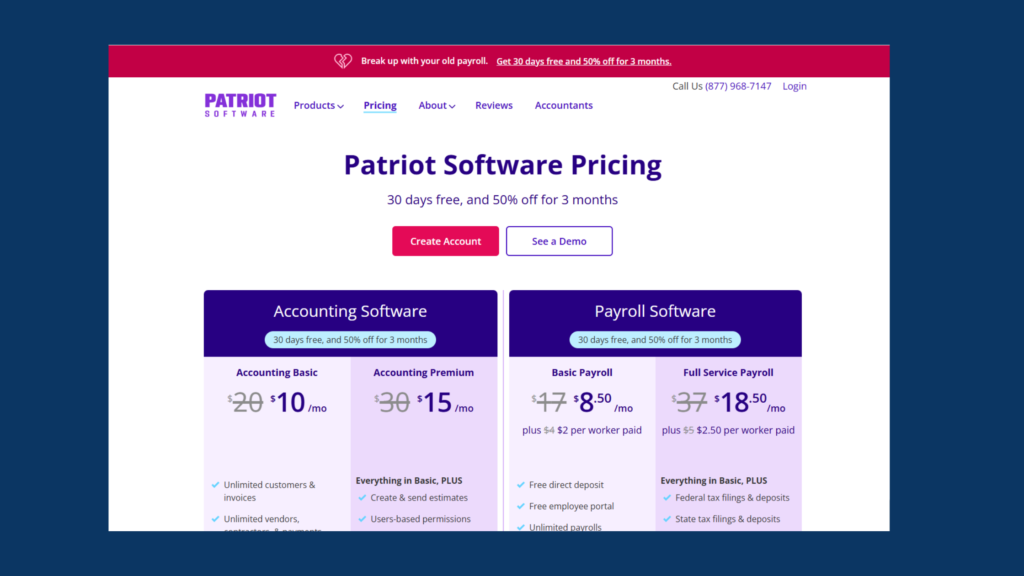

2) Patriot Payroll — Cheapest Core Payroll Option

Best for: Solopreneurs and microbusinesses with tight budgets.

Pricing

- ~$10 base per month (core)

- ~$4 per employee (core)

- ~$30 base per month (full service) + ~$6 per employee

What You Get

✔ Basic payroll processing

✔ Direct deposit

✔ Add-on tax filing

Why It’s Affordable

Patriot charges extremely low base fees, making it one of the cheapest real payroll services available.

Pros

- Very low entry cost

- Simple setup

- Quick onboarding

Cons

- Full tax filing is an add-on

- Fewer advanced features

- Manual steps may be needed for compliance

Best if keeping payroll costs ultra-low matters most.

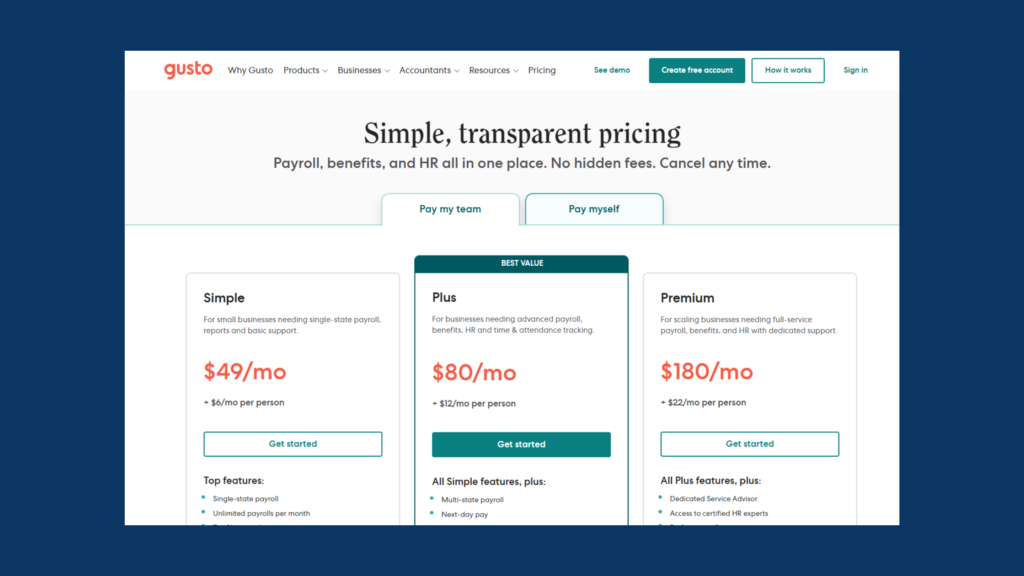

3) Gusto (Simple Plan) — Affordable With Full Tax Filing

Best for: Small teams who want payroll simplicity + compliance automation.

Pricing

- ~$49 base per month

- ~$6 per employee

What You Get

✔ Federal & state tax filing

✔ Next-day pay options (higher tiers)

✔ Contractor support

✔ Employee self-service

Why It’s Affordable

While priced similarly to OnPay, Gusto offers excellent UI and team tools that make payroll easier for beginners.

Pros

- Strong automation

- Intuitive interface

- Excellent customer support

Cons

- Add-ons for benefits can increase cost

Best if you want full payroll features without enterprise pricing.

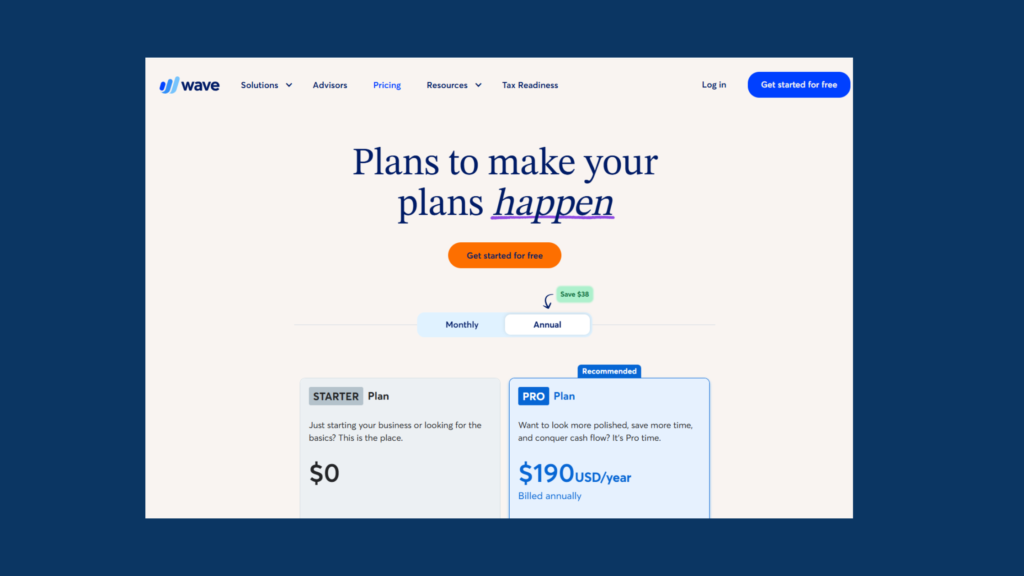

4) Wave (with Integrations) — Budget Entry Pathway

Best for: Very early-stage businesses and freelancers.

Pricing

- Free core platform

- Payroll via third-party integrations (paid add-ons)

What You Get

✔ Free accounting dashboards

✔ Basic invoicing

✔ Add-on payroll services

Why It’s Affordable

Wave itself is free, so you can use basic financial tools, then plug in a low-cost payroll add-on.

Pros

- Free bookkeeping tools

- Good entry point

- Works well with freelancers

Cons

- Payroll isn’t included — requires integrations

- Limited reporting

Best if you want the lowest entry cost and already use Wave for accounting.

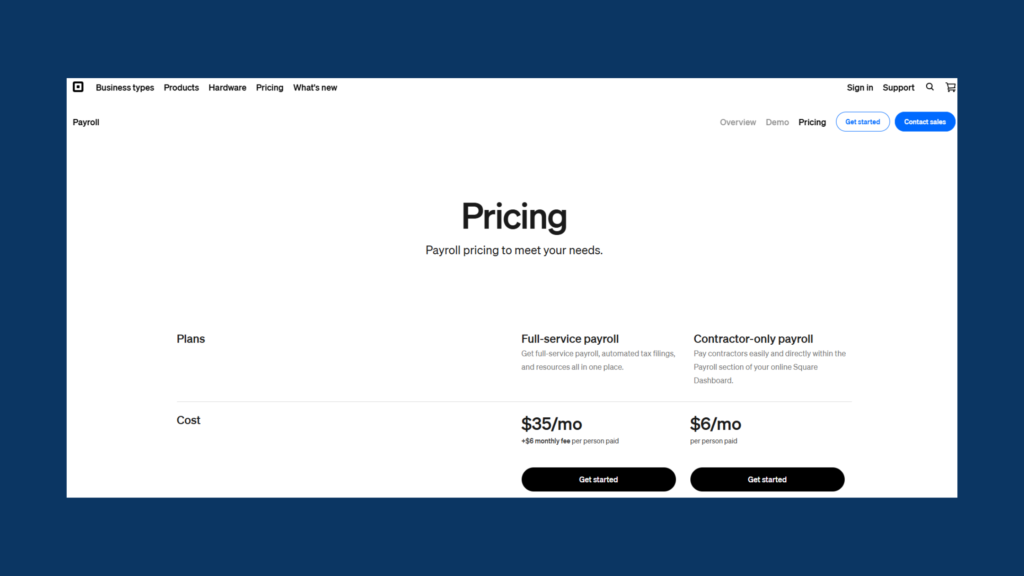

5) Square Payroll — Best Affordable for Retail & Service SMBs

Best for: Small retail and service businesses with pop-up teams.

Pricing

- ~$35 base per month

- ~$6 per employee

- Tax filing included

What You Get

✔ Automated payroll tax filing

✔ Seamless integration with Square POS

✔ Contractor payroll

✔ Timecard syncing

Why It’s Affordable

Square combines payroll with POS tools, making it easy for businesses already in the Square ecosystem to manage paychecks seamlessly.

Pros

- Strong for retail/service businesses

- Integrates with Square products

- Easy time tracking

Cons

- Less powerful for larger teams

- Not ideal if you don’t use Square POS

Best for businesses already in the Square world.

How Affordable Payroll Services Charge (What to Expect in 2026)

Most services use a simple hybrid pricing model. This may include the following:

i) Base Monthly Fee

Paid every month — usually $10 to ~$50+, depending on service.

ii) Per Employee / Contractor Fee

A recurring fee for each person you pay.

iii) Add-Ons

Optional extras like:

- Enhanced compliance alerts

- Contractor-specific features

- Benefits administration

- Time tracking modules

How to Choose the Right Affordable Payroll Service

Ask yourself:

a) How many employees do I have?

Small teams = cheaper options like Patriot or OnPay

Larger small teams = Gusto or Square

b) Do I need full tax filing included?

If yes → OnPay, Gusto, Square

If no → Patriot (tax add-on)

c) Am I already using accounting software?

Integration matters:

- QuickBooks Payroll, if you use QuickBooks

- Wave integrations, if you use Wave

What Small Business Owners Should Consider in 2026

Payroll decisions should factor in:

>> Tax Compliance

Late or incorrect payroll taxes = penalties.

>> Ease of Use

The simpler the UI, the fewer mistakes.

>> Add-Ons vs Core Features

Compare total monthly cost, not just base price.

>> Growth Path

Don’t outgrow your payroll system in 6–12 months.

Frequent Pricing Mistakes to Avoid

- Choosing solely based on base price

- Ignoring per-employee fees

- Forgetting about multi-state tax costs

- Paying for add-ons you don’t use

A true pricing comparison should consider total annual cost, not just the monthly starting price.

Final Verdict: Best Affordable Payroll Services (2026)

| Best For | Recommended Payroll |

|---|---|

| Lowest Cost Payroll | Patriot Payroll |

| Best All-Around Value | OnPay |

| Best with Tax Filing Included | Gusto |

| Best Retail/Service | Square Payroll |

| Budget Entry Pathway | Wave + Integrations |

The right choice depends on your:

- Team size

- Budget

- Compliance needs

- Accounting software ecosystem

Related Resources You May Find Helpful

➡️ Best Payroll Software for Small Businesses (2026)

➡️ Payroll Software Pricing Comparison (2026)

➡️ Best Accounting Software with Payroll Included (2026)

These pages work together to help you pick the best tools for your business stage.

Want a different software? Start your free trial with Xero today!